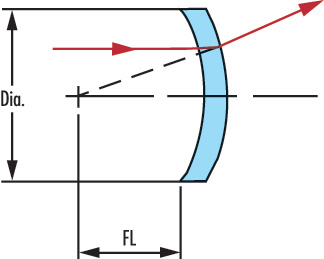

Meniscus cylinder Lens can increase the NA of the system while only adding slightly to the total spherical aberrations. The Negative Meniscus cylinder Lens is used to increase the focal length of another Cylindrical Lens while maintaining the angular resolution of the optical assembly. This lens shape is best used when one conjugate is relatively far from the cylindrical lens.

Some styles of cylindrical lenses have antireflective coatings to increase the transmission of light through the lens.

Fused silica cylinder lenses are ideal for demanding laser machining and medical applications.

Negative Meniscus cylinder lens   Â

Â

Â

Positive Meniscus cylinder Lens

Â

Specification of our meniscus cylinder lens or Plano-Convex Cylindrical Lens as follow:

*Material: BK7,Ge,UV-grade fuse silica(JGS1,JGS2,JGS3)or other optical materials

*Dimension Tolerance: +0.0 -- -0.1mm

*Center Thickness: +/-0.1mm

*Focal Length Tolerance: +/-1%

*Surface Quality:20/10

*Surface Figure: lambda/2 at 633nm on plano side

*Clear Aperture>90%

*Chamfer: 0.25mm at 45 degree typical

*Coating Optional

Meniscus Cylinder Lens,Optical Glass Meniscus Cylinder Lens,Meniscus Spheric Lens,Meniscus Cylindrical Lens

China Star Optics Technology Co.,Ltd. , https://www.csoptlens.com